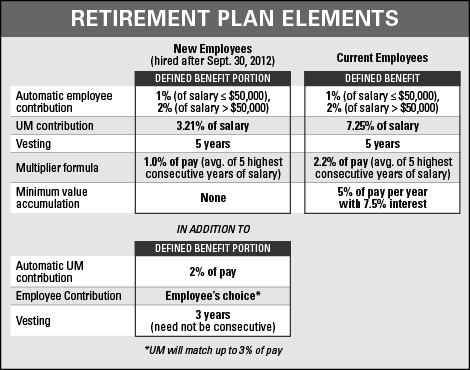

After roughly two years of discussion, the University of Missouri Board of Curators during its October meeting approved a new retirement plan for employees hired after Sept. 30, 2012. The current university defined benefit plan for existing employees and retirees remains unchanged.

The recently passed plan for new employees is part defined benefit and part defined contribution.

Defined benefit plans guarantee employees a future level of income upon retirement, and have been popular in the public sector for many years. But the growing volatility of funding these plans has been the challenge.

Defined contribution plans, similar to 403(b) plans, guarantee a fixed contribution from the employer now, with the amount available at retirement based on investment returns and additional voluntary employee contributions.

Defined contribution plans have been popular with younger employees — who tend to switch jobs more often — but require employees to be more involved in managing their investments.

Under the new plan, employees hired after Sept. 30, 2012, will choose among investment

options for the defined contribution portion of the plan. A variety of funds will be available for those who want to actively manage their investment as well as Life Cycle or Target Date funds, for those who prefer to make to make a single choice geared to their expected future date of retirement.

“The new plan design will allow the university to better moderate risk and volatility, help ensure the existing plan’s long-term viability for current employees and retirees and offer new employees a fair and equitable retirement plan that is growing in popularity among public higher education institutions,” Stephen J. Owens, University of Missouri interim president said in a UM System news release.

The UM Board of Curators first voted in June 2011 to close the current retirement program to new employees beginning late next year. Since then, the board has received regular updates on new retirement plan draft designs before approving the final plan design in late October.

To view the details of the plan, see the accompanying chart.