iStock photo

This year is different.

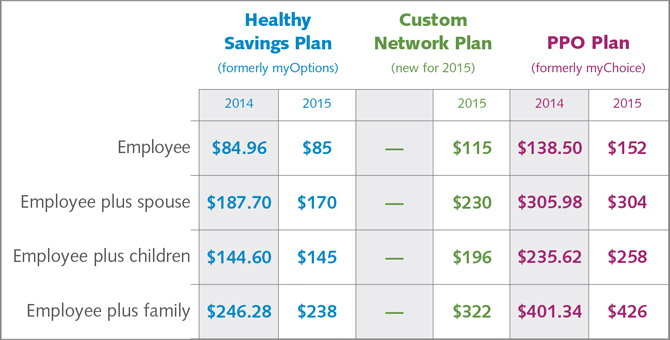

Instead of two benefit plan options for MU employees for 2015, there are three: the Healthy Savings Plan (formerly myOptions), the Custom Network Plan (new for 2015) and the PPO Plan (formerly myChoice).

Also, all benefit-eligible employees must choose a plan or opt out during enrollment Oct. 20-31. This includes employees who want to keep their 2014 plan, change to an alternative plan or continue to opt out. If no action is taken, employees will default to the Healthy Savings Plan and pay taxes on the premiums.

Retirees are not required to act and can choose to do nothing if they are happy with their current elections. Enrollment for retirees is Nov. 3-14.

Benefit plans at a glance:

• Healthy Savings Plan: Premiums for 2015 are $85 self; $170 self plus spouse; $145 self plus children; $238 self plus family. This plan includes the Health Savings Account (HSA), which can help reduce your taxable income and provide a savings account to be used for health care expenses.

• Custom Network Plan: This new plan for 2015 will offer a midlevel premium (between the Healthy Savings and PPO plans), $0 deductible and reduced co-payments.

Premiums are $115 self; $230 self plus spouse; $196 self plus children; $322 self plus family. This plan is only for benefit-eligible MU employees who live or work in Columbia-area counties: Cole, Cooper, Howard, Moniteau, Osage, Randoph, Audrain, Boone and Callaway. This network gives employees access to MU Health Care and Capital Region Medical Center providers, clinics and hospitals. (Visit www.ummedcvty.com to see the list of network providers.)

• PPO Plan: Premiums for 2015 are $152 self; $304 self plus spouse; $258 self plus children; $426 self plus family. With this plan, employees have the choice of seeing in-network or out-of-network providers. If participants stay in-network, costs might be much lower.

“Employees should consider their health and financial needs and determine which plan is the best for them and/or their family,” said Kelli Holland, manager of communications and training at the University of Missouri System.

The biggest difference in premiums is between the Healthy Savings Plan and the PPO Plan. For example, for the Healthy Savings Plan, the premium for self is $85; for the PPO Plan, self coverage is $152. However, the Healthy Savings Plan also comes with a $1,500 deductible for self, while the PPO Plan has a $350 deductible for self.

Compare all three plans in Your 2015 Annual Enrollment Guide online booklet. Below is a comparison of premiums.

Source: University of Missouri System

Expanded resources for this year’s annual enrollment include:

• Your 2015 Annual Enrollment Decision Guide.

• myBenefits Decision Center: Available in October within myHR, this online system will allow you to make side-by-side comparisons of the plans offered.

- Town hall meetings: Get an overview of what's new this year and the details of medical plans. Town halls are through October. View the schedule.

- Departmental meetings: Human resource specialists are visiting schools and departments to deliver educational presentations. Managers may request a presentation at umhraetotalrewards@umsystem.edu.

- One-on-one meetings: Attend a one-on-one personal consultation with a benefits specialist. These sessions are through October. View the schedule and sign up.

For more information, contact Campus Benefits Representative, the HR Service Center at (573) 882-2146 or HRServiceCenter@umsystem.edu.