Depending on when you began work at MU, your core retirement plan might look a little different than your colleague’s. But what’s most important is that you understand the voluntary saving options available to you and are taking advantage of them.

“[Faculty and staff] need to be saving for retirement, no matter how little or how much they make,” said Betsy Rodriguez, vice president for human resources for the University of Missouri System. “At a young age, they need to be planning for retirement.

“But it’s never too late to start,” she quickly added.

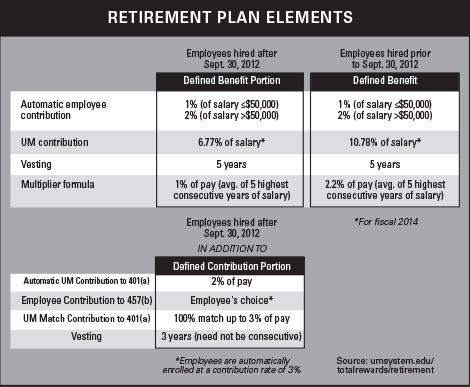

For more than 50 years, the university has administered a defined benefit plan in which benefit-eligible employees are automatically enrolled. After becoming vested, i.e., at least five years of service, employees may be eligible for a monthly benefit for life based on age, years of service and a benefit multiplier upon retirement.

In 2012, the UM System restructured the retirement plan for employees hired after Sept. 30, 2012. These newer employees maintain a defined benefit plan. They also have a defined contribution plan, in which an employer contribution of a fixed 2 percent of salary is deposited into a 401(a) account. Employees are automatically enrolled in a 457(b) plan at a contribution rate of 3 percent of salary. The university will match 100 percent up to 3 percent of the employee contribution, which is deposited into the 401(a) defined contribution plan. Employees may change their contribution rate to the 457(b) plan; however, to obtain the maximum contribution from the university, they should contribute at least 3 percent.

The money available at retirement in a defined contribution plan is based on employer and voluntary employee contributions and investment returns. This new plan requires employees to be more involved in managing their investments.

All UM System employees may contribute to voluntary retirement plans, including a 403(b), 457(b) and 401(a), but only one in five employees takes advantage of these voluntary savings plans.

To learn more:

• Visit mysavingsatwork.com/UMRetirement. Through the site, employees can set up a free, confidential one-on-one consultation with a licensed retirement representative. Be sure to capitalize the UMR in the URL.

• Attend the one-hour “Understanding Retirement” training session May 21 in 207 Memorial Union South: 9 a.m. for those hired before Oct. 1, 2012, or 10:30 a.m. for those hired on or after that date. Register at hrs.missouri.edu/training, or call 882-2602. The workshops are part of Staff Recognition Week.

— Kelsey Allen