Mizzou’s median student borrowing is 30 percent lower than the national average

In order to help students manage debt after graduation, the University of Missouri’s Student Financial Aid office and the Office for Financial Success (OFS) are launching a new counseling program that provides one-on-one counseling sessions for students. In the program’s first two weeks of operation, approximately 500 students have scheduled appointments.

“As spring commencement approaches, we often get a lot of questions from graduating students about their loans and how they will repay them,” said Nicholas Prewett, MU director of financial aid. “Exit counseling is a federal requirement and, usually, is completed online. However, our students told us that they wanted more detailed information. So we created this counseling service, so that students could get one-on-one advice from financial professionals.”

Students can use the counseling service to seek advice on loan history, choices of repayment plans, options available through the federal government, deferment and forbearance options, loan forgiveness and cancellation provisions, and the pros and cons of loan consolidation.

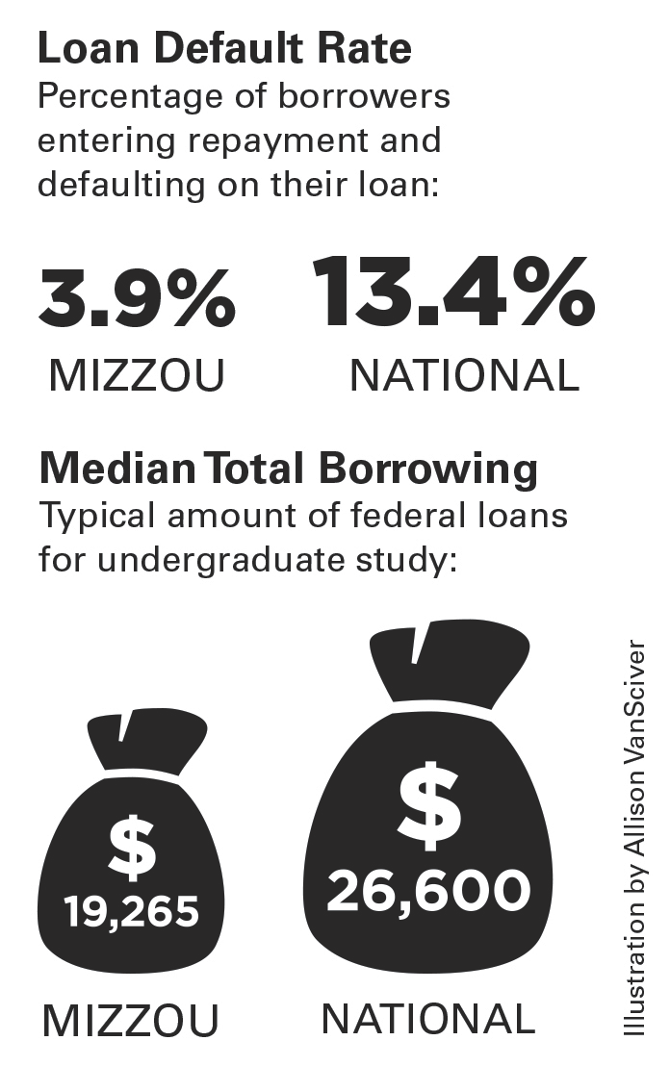

MU’s median student borrowing is 30 percent lower than the national average. The average MU student loan borrower will pay about $222 per month after graduation.

“We believe that it is increasingly important for students to understand their finances after they graduate and how any amount of debt will impact their budgets,” said Ryan Law, director of OFS. “Not only do staff members from the Office for Financial Success have educational backgrounds in financial planning, they also are trained peer counselors. They can help students in almost any type of situation.”

While the counseling service is new on campus, Prewett has seen an immediate interest from the student body.

“We’re very pleased with the initial response to this program,” he said. “This demonstrates to us that our students understand the responsibility of financial debt and are working to make sure they handle their future finances responsibly.”

The one-on-one counseling services for students are available 9 a.m.–3 p.m. Monday through Friday in the OFS or by appointment. OFS is a part of the College of Human Environmental Sciences at MU.

— Jerett Rion